Where You Put Your Money Matters

The financial decisions you make shape your future, understanding the implications of your decisions is our specialty. We help you find hundreds of thousands of dollars you're losing, bring it back to you, for you to enjoy and grow. We help you protect, save, and grow your wealth for generations to come.

Discover personalized IV vitamin therapies, hormone treatments, and holistic wellness solutions in our tranquil sanctuary designed for your total rejuvenation.

Where You Put Your Money Matters

Your financial choices shape your future. We help you invest wisely, protect your wealth, and create lasting security for generations to come.

Your financial choices shape your future. We help you invest wisely, protect your wealth, and create lasting security for generations to come.

About Us

About Premier Wealth Concepts

At Premier Wealth Concepts, we believe you're a better steward of your money than the government will ever be.

Are you a high income earner diligently deducting and deferring in order to create big pile of money, yet you feel broke? Bigger, higher, greater, more, is not a path that will get you where you want to go. Building wealth is more than numbers on a statement.

We help our clients retire sooner, with significantly more cash flow, utilizing assets that never stop growing. Our mission is to teach you how wealth really works, so you can win.

check our services list

Our Services

The Financial Strategy designed to protect, grow, and nurture your legacy.

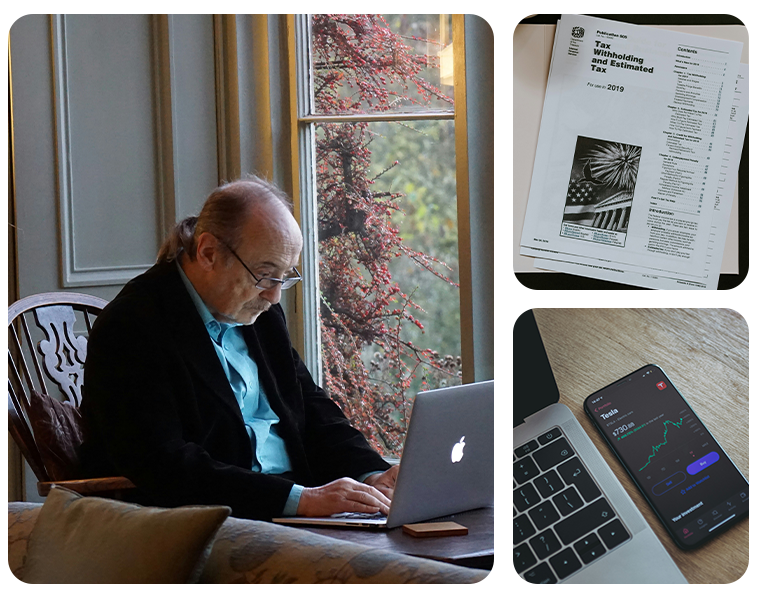

Protection

Financial resilience occurs when you're prepared for life's uncertainties, inevitable curve balls, and unexpected challenges. Protection includes minimizing or eliminating losses, losses to taxes, fees, expenses, inflation, interest on debt, sickness, injury, pandemics, catastrophes, job loss, divorce, and premature death. We focus on laying down an unbreakable foundation through efficient, perfected, and tailored strategies, using only prudent financial tools within the industry, proper estate planning, and maximum liability coverage.

Savings

Efficiently optimizing wealth requires maintaining control of your money during one's lifetime, not forfeiting it. The ability to draw on your money during your lifetime offers comfort and stability when emergencies arise. Freedom and access to it ensures you can capitalize on opportunities as they present themselves. Our's is the only strategy that allows for uninterrupted growth while benefiting from the use of it by way of collateralization. We believe everyone could become wealthier if they were only taught how wealth really works. We teach you how to play the game to win.

Growth

We believe having access to your money during your lifetime increases your chances of success. Our advanced wealth strategy is a collateralized asset that grows uninterrupted, offers dividends, and is exempt from taxation. We work closely with real-estate gurus, equity investors, business owners, and families. We come alongside you, walking you through the implications of the choices you have. The path to a very rich lifestyle starts with securing maximum protections, control of and uninterrupted growth of your capital, and enjoying tax exempt cash flow throughout your entire life.

Why Choose Us

The Premier Advantage:

What Sets Us Apart

Proven Expertise

Years of experience in maximizing wealth and protections, ensure strategies that deliver results.

Personalized Approach

Your goals matter—not only will our strategies get you there, we'll get you there quicker.

Commitment to Trust

We build relationships based on transparency and integrity. We offer facts, not opinions.

Client Testimonials

You had me at........

You had me at.......

Tax Exempt!

Client Name

Position

Michael

Tax Payer

You had me at....

Reaching my dream goal quicker!

Client Name

Position

Jane

Business Owner

You had me at.....

Knowing I'll never run out of money.

Client Name

Position

Scott

Retiree

You had me at......

More Income & More Legacy!

Client Name

Position

Gaye

Single Mom

You had me at........

Adding $1million dollars to my life!

Client Name

Position

Jay

Dad

You had me at......

Making sure I don't burden my kids when I'm old and need assistance.

Client Name

Position

Joe & Sandy

Gampy & Gammy

Client Testimonials

Happy Clients, Happy Legacy!

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Client Name

Position

Client Name

Position

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Client Name

Position

Client Name

Position

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Client Name

Position

Client Name

Position

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Client Name

Position

Client Name

Position

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Client Name

Position

Client Name

Position

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Client Name

Position

Client Name

Position

FAQ

Frequently Asked Questions

1. What services do you offer?

Most people are giving away up to 80% of their wealth. We educate you on how not to over pay for large ticket items during your lifetime like taxes, fees, college education, interest on debt, etc. We can implement legacy planning, including wills and trusts. We offer perspective on the most efficient ways to pay for Auto, Home, Life, Disability, and Long Term Care, so you get to keep more of your hard earned money.

2. How do I know which financial strategy is right for me?

We've simplified the process for you. We show you what will happen if you continue doing what you're doing, then we show you what you CAN do. We have found people prefer facts over opinions, and education over recommendations. We believe you would ask all the right questions, if you only knew what to ask. We educate you on the questions you should, could, would ask, and in turn you'll know what the right strategy is for you. We then help those who will benefit from it.

3. Do you work with clients outside of my location?

Yes. We work with clients across various states. We have found that most folks prefer virtual consultations from the comfort of their own home. We will offer in-person consultations when it makes sense.

4. Is my information kept confidential?

Absolutely. Protecting your personal and financial information is a top priority. We adhere to strict confidentiality policies and use secure systems to safeguard your data.

5. How do I get started?

Simply contact us and introduce yourself, strangers are just friends we haven't met yet. We'd love to connect and see what you're striving to accomplish in life. We’d know very quickly if we would work well together. If you're anything like me, and I know I am, you'd appreciate working with facts not opinions, real numbers not estimates, and to retire sooner rather than later. Should we move forward we will take a snapshot of your current financial situation and give you more of what you want and less of what you don't. What we're known for is adding a million or more dollars to your life, who wouldn't want that!

Join Our Wealth Community

Access expert insights and connect with others committed to growing and protecting wealth.

Premier Wealth Concepts helps you protect, grow, and preserve wealth through personalized, proven, and trusted financial strategies.

Work Hours

8 AM - 6 PM, Monday - Friday

I'm here to assist you with any queries and will respond as quickly as possible.

Copyright © 2025 Premiere Wealth Concepts. All rights reserved

Privacy Policy

Terms of Service

© 2025 Company Name LLC . All rights reserved